Few concepts in accounting and financial reporting are as fundamental and misunderstood as the trading account. If you’re a student studying accounting and are new to accounting, then I believe the List of Trading Accounts Format must be quite challenging for you. The Trading Account Format at its heart is designed to answer a straightforward yet fundamental question: Is the firm making any money from its core trading activities? In this article, we will delve into how the trading account is organised and why its structure is important, and how to create one with clarity and confidence.

What is Trading Account Format?

But before plunging into the format, let’s first understand what the Trading Account Format is. In simple terms, a trading account is an account or ledger that is maintained on an end-of-the-year basis. Their objective is to arrive at gross profit or gross loss, which could be realised out of the normal business activities, mainly buying and selling of goods. It does this by displaying a comparison between direct costs and direct revenues.

This makes the trading account the first step in preparing final accounts, acting as a bridge between raw financial data and insightful business performance analysis. Unlike a profit and loss account, which accounts for all indirect expenses and incomes, the trading account focuses only on direct items those immediately tied to trading activities.

Why the Format Matters

The form of the trading account is not just an empty shell; it constitutes a structure in which the accounting information must be properly organised and displayed. It is based on classical accounting principles and provides a systematic way of collecting and comparing numbers, so that accountants, managers, as well as other parties interested in the outcome can understand what has happened to an organisation.

A frequently used arrangement is the T-form, where costs appear on the left and revenues on the right. The simple structure already includes the double-entry bookkeeping system and opens the calculation.

Must Read-: Dividend Distribution Tax: Meaning, Impact, and Current Tax Rules in India

Trading Account Format Explained

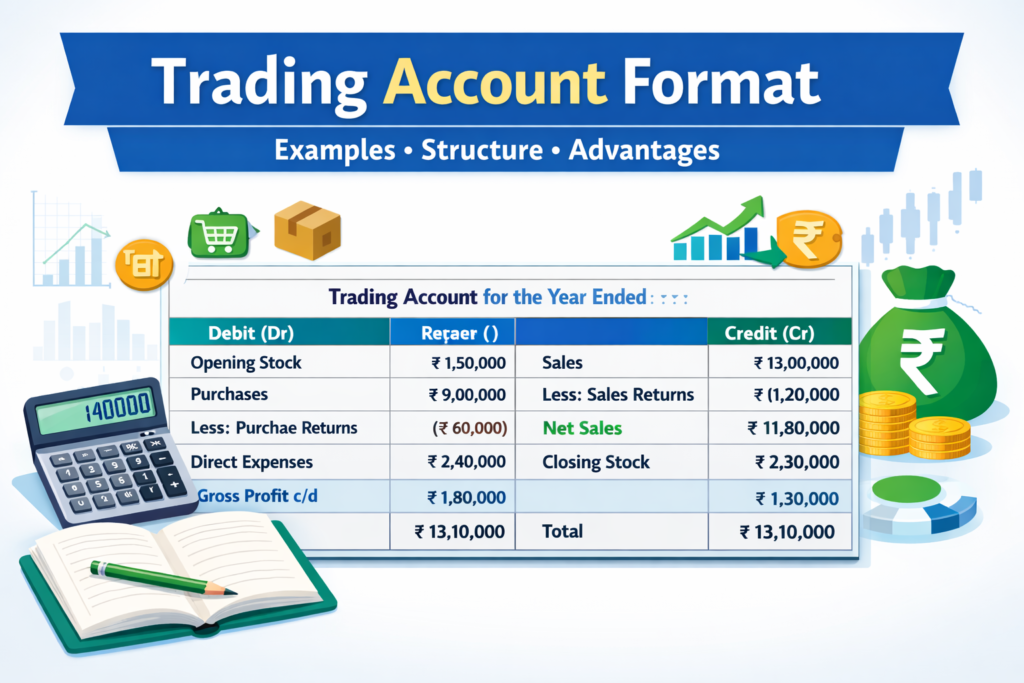

In traditional accounting, the trading account is presented in a table with a debit (left) side and a credit (right) side. The debit side lists all direct costs incurred in generating sales, such as opening stock, purchases, and direct expenses. The credit side, on the other hand, shows income generated, mainly from sales and the value of closing stock.

Here’s how it typically looks:

Trading Account for the Year Ended DD/MM/YYYY

| Trading Account for the Year Ended DD/MM/YYYY | ||

|---|---|---|

| Dr (Expenses / Costs) | Amount (₹) | Credit (Revenue / Income) |

| Opening Stock | XXXX | Sales |

| Purchases | XXXX | Less: Sales Returns (if any) |

| Less: Purchase Returns | (XXXX) | Net Sales |

| Direct Expenses (Wages, Freight, etc.) | XXXX | Closing Stock |

| Gross Profit c/d (Balancing Figure) | XXXX | |

| Total | XXXX | Total |

This simple table reflects how direct costs are set against revenue items to calculate gross profit (if credit side > debit side) or gross loss (if debit side > credit side).

Breaking Down the Components

1. Opening Stock

This is the value of goods which are available for sale at the start of the period. It is essential to have the opening stock correct, as this value directly impacts gross profit computation.

2. Purchases and Purchase Returns

Purchases: The cost of goods purchased during the year. If any goods were returned to suppliers, this amount is deducted here, ensuring that only NET PURCHASES are included.

3. Direct Expenses

These are costs directly connected to the production or acquisition of goods, like direct wages, freight, carriage inwards, power, and factory expenses.

4. Sales and Net Sales

This is the total income from selling goods. If there are sales returns (goods returned by customers), they are deducted to arrive at net sales.

5. Closing Stock

This reflects the value of goods still unsold at the end of the period. It is added to revenues because unsold goods still hold value for the business.

A Practical Example

To make this more relatable, consider the following simplified scenario:

Suppose XYZ Traders is preparing its trading account for the year ended 31st March 2025. Their financial figures are:

-

Opening Stock: ₹1,00,000

-

Purchases: ₹8,50,000

-

Purchase Returns: ₹50,000

-

Direct Expenses (Wages + Freight): ₹2,00,000

-

Sales: ₹12,00,000

-

Sales Returns: ₹1,00,000

-

Closing Stock: ₹2,00,000

Trading Account for the Year Ended 31/03/2025

| Trading Account for the Year Ended 31/03/2025 | ||

|---|---|---|

| Dr | Amount (₹) | Cr |

| Opening Stock | 1,00,000 | Sales |

| Purchases | 8,50,000 | Less: Sales Returns |

| Less: Purchase Returns | (50,000) | Net Sales |

| Direct Expenses (Wages + Freight) | 2,00,000 | Closing Stock |

| Gross Profit c/d | 1,40,000 | |

| Total | 12,40,000 | Total |

From this, the gross profit is ₹1,40,000, representing the difference between revenues and direct costs.

Why This Structure Is Valuable

Preparing the trading account in this format accomplishes several practical things:

-

Clarity in Cost vs Revenue: It clearly separates costs directly tied to trading from income sources, allowing you to see whether the core trading operations are profitable.

-

Foundation for Other Accounts: The trading account is not the last; it only provides the figures to the profit and loss account, which, in turn, deducts indirect expenses to find out the net profit.

-

Decision Making: With gross profit knowledge, a business can evaluate price strategies, manage direct cost and determine stock investment.

Advantages Beyond Numbers

Beyond calculations, the trading account format plays a pivotal role in broader financial management. It helps:

-

Identify patterns in direct costs

-

Assess operational efficiency over time

-

Support inventory management decisions

-

Aid transparency for investors or auditors

Although it does not capture indirect expenses like administrative overheads or taxes, its focused view on trading dynamics remains invaluable for management and financial reporting alike.

Conclusion

More than a collection of numbers, the trading account format is how a business analyses whether or not it can trade and make money. Regardless of whether you’re preparing accounts for the first time or coaching a colleague on how to do it, grasping the layout and logic of this format will help you go beyond mere reformatting and produce more accurate financial numbers.

Once you understand elements like opening stock, purchases, direct expenses and closing stock, you will be able to interpret gross profits and begin to take the proper first steps toward financial analysis.

If you take nothing else away from this article, remember this: the trading account layout is your first insight into a business’s financial well-being.

Must Read-: How to Calculate Distance Between Two PIN Codes for E-Way Bill in India – Complete Guide (2026)