In India’s huge logistics landscape, producing an e-Way Bill has emerged as a basic compliance prerequisite when it comes to moving goods valued at ₹50,000 and above. Although most of the business units are aware those basic steps of generating an e-Way Bill, knowing to calculate distance between two PIN codes, the another vital part in generation of e-way bill is also very necessary. This article sheds light on what is pin to pin distance, how it’s calculated, why does it matter and how can you ensure adherence to GST regulations during e-way bill generation.

What Is an E-Way Bill?

Before we try to understand PIN-to-PIN new distance, let’s take a brief moment to remember “What is an e-Way Bill”.

What is e-Way Bill? e-Way bill is a document required, which needs to be carried by a person in charge of the conveyance carrying any consignment of goods of value exceeding fifty thousand rupees as mandated by the Government in terms of Korlátozások txt 1908 to The GST Portal. It is mandatory when you are transporting goods worth ₹50,000 and above in intra-state (within the state) or inter-state (between two states). Penalty under e-Way Bill If the consignor or transporter transfers goods without a proper e-Way Bill, he/she can be fined.

Why is Distance Relevant for an E Way Bill?

When you generate an e-Way Bill, here is one of the important information that you have to provide: The distance for movement of the goods from source to destination. This matters on a couple of fronts:

Validity of the E-Way Bill

The time till which the e-way bill is found valid (i.e., the validity of the e-Way Bill) depends on distance as follows:

- The e-Way Bill validity is 1 day upto 100kms.

- Additional validity is credited for each additional 100 km (or fraction thereof).

Compliance

You may encounter system warnings or even rejection of the e-Way Bill if the distance is way off from the portal parameters.

Avoid Manual Errors

Yet with so many possible routes and combinations it is easy to make mistakes when estimating distances by hand. There are tools available in GST e-Way Bill System to automate this process and minimize conflicts and errors.

What Is PIN-to-PIN Distance?

Postal Index Number code (PIN) is a six- digit number provided to every post offices in India. PIN codes allow the GST system to pin a location on a verified geospatial area.

PIN-to-PIN distance refers to the motorable length of road between the two physical locations corresponding to two distinct PIN codes: one for origin and the other for destination. This distance calculated here is crucial in determining how much distance the goods will cover and subsequently for an e-Way Bill to determine till when or how long it should be valid.

Calculation of Distance by E-Way Bill Portal

The e-way bill system under GST has an inbuilt platform to measure the distance between two PIN codes. Here’s how it works:

- When ‘From PIN Code’ and ‘To PIN Code’ is entered in the portal, that system’s internal database is being referred to get distance from motorable route.

- The approximate motorable distance will be shown in the portal, however considering use of it towards generation of e-Way Bill.

- If you don’t enter a value (which results in it being left to zero), the system tries to auto-fill the closest distance available from its own database.

Note: The distance estimates are based on road network not a straight line; roads may be national highways, state highways, and other major roads to provide motorable distance from the court or tribunal premise.

PIN-to-PIN DISTANCE Calculation Step by Step Helper Texts (APDB & PTA values)

Here is how you can use the GST portal to find out distance between two PIN codes:

Step 1: Open E-Way Bill Portal

Visit the e-Way Bill portal at ewaybillgst. gov.in.

Step 2: Go to the Search Tab

From the homepage drop down or click ‘Search’. A dropdown will appear.

Step 3) Then ‘PIN to PIN Distance’

You will see the option that says “PIN to PIN Distance”.

Step 4: Enter the PIN Codes

Input the PIN of Source(in the case of recharging) in the first field and PIN of Destination(in the case of recharging for another), or vice-versa.

Step 5: The Measured Distance Appears(In this case it’s 648.55m)

Click Submit or Search. The distance between the two PIN codes will be shown on the portal. You can also quote this value when you fill up the “Distance” in e-Way Bill.

Manual distance entry and what about tolerance rules?

Despite the system offering an estimated distance, on occasion you might want to input your own figure. But there are rules and constraints:

10% Tolerance Rule

In case you wish to enter a real distance traveled (like in a detour or different route), the digital GST portal permits to punch in 10% more than auto-calculated. This allows for realistic route changes, but avoids large deviations.

Same PIN Code Rule

If the source and destination PIN code are same (like in a city or complex), maximum distance user can enter is :

- 100 km: if it’s a standard purchase.

- 300 km: only for Line Sales Supply Type (TR- Transfer with in branch without any conditions you selected).

Invalid PIN Codes

If an incorrect or unknown PIN is detected, the user will be alerted. If you do so, you can still mention the distance manually however such e-Way Bills will be subject to subsequent verification of the same.

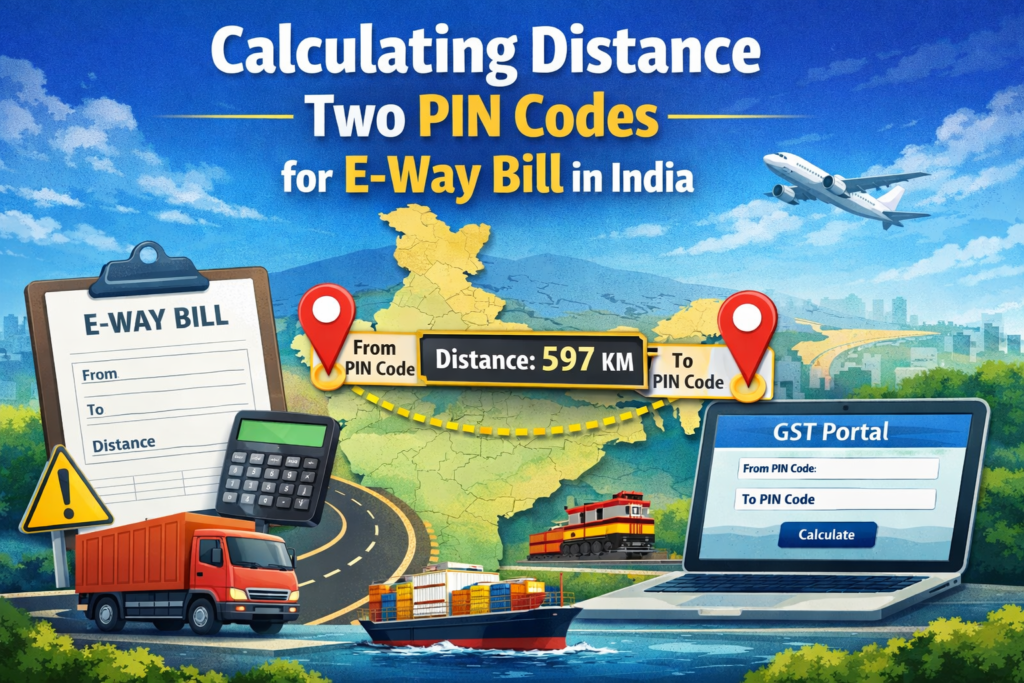

Example: Distance Between PIN Codes

Here is a simple example:

- Source PIN: 452002 (Indore, Madhya Pradesh)

- Destination PIN: 400001 (Mumbai, Maharashtra)

According to the portal’s PIN-to-PIN distance tool, the approximate motorable distance is 597 kms. You can use this distance while creating your e-Way Bill.

Why Auto-Calculated Distance Is Useful

The auto-calculated distance based calculation feature in the e-Way Bill system has multiple advantages for businesses.

Reduces Manual Errors

Before, companies would have difficulty calculating exact distances with a third-party map or source. The included tool provides consistency and enforcement.

Faster e-Way Bill Generation

The faster e-Way Bills can be generated as the distance is easily available from the portal.

Reduced Compliance Risks

The use of the official portal estimate minimises discrepancies during inspections or audits, as the estimated values from the portal are used as a benchmark.

Common Questions (FAQs)

The following FAQs will help you understand some common questions concerning PIN-to-PIN distance in e-Way Bill:

Q: Do I have to use auto-calculated distance?

You can either accept the auto-calculated distance or type in your own distance, however this manualy selected range must be within ±10% of the portal value.

Q: What if it is impossible for the portal to determine the distance between two PINs?

For certain pairings of PIN codes if e-Way Bill system has no database entry, it will throw an alert and you have to manually provide the actual distance.

Q: Could the distance be greater than 4,000 km?

No. e-Way Bill distance > 4,000 km Description: The GST portal caps the ‘distance’ entry for e-way bills to a maximum of 4000 km.

Q: What is the procedure if I get the distance wrong?

Incorrect or nonfeasible distances may cause either the latter errors or rejection. e-Way Bills can be blocked temporarily in some cases, till rectified. Remember to double-check the distance before submitting it.

Practical Tips for Businesses

Here are some ways to make measuring distance easier:

✅ Always use the portal distance tool first before manually entering the distance.

✅ Fixed inconsistency of the distance auto calculated with the one actually traversed.

If ever audited, do your calculation in-house and document the logic of how you did it (screen shot the PIN-to-PIN distance screen and stuff).

✅ Double-check PIN codes to avoid incorrect combinations that cause problems in generation of e-Way Bill.

Conclusion

How to calculate the distance between two PIN codes is a little, but important part of filing e-Way Bill in India. It impacts the legality of bills, compliance and are they even legal. The built-in PIN-to-PIN distance calculator in the GST portal allows businesses to now generate e-Way Bills with confidence based on accurate route distance and without any calculations of actual distances, as well as reduces manual errors. By knowing where the rules are for distance, tolerances and exemptions, a business can keep in line but also streamline its logistics operation.

Must Read-: Dividend Distribution Tax: Meaning, Impact, and Current Tax Rules in India