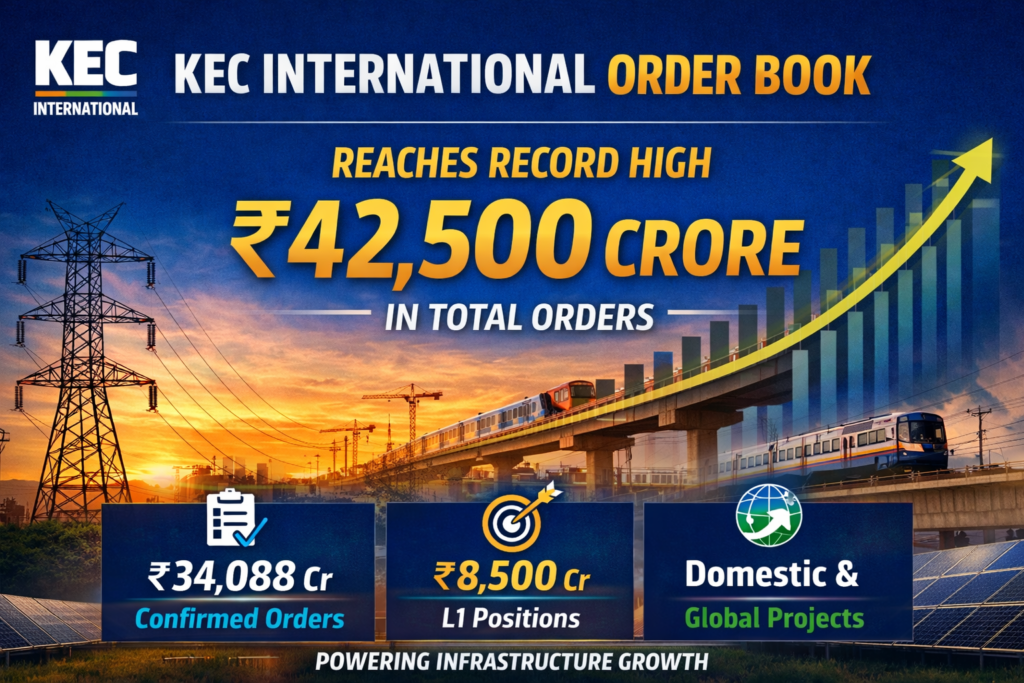

KEC International – Order Book India’s infrastructure EPC major KEC International is buzzing on an account of its highest ever order book caused by its robust market presence and growing international reach. As of the most recent reported numbers, KEC International’s aggregate order book (confirmed + L1 or lowest bidder) is in excess of ₹42,500 crore – the highest ever order backlog witnessed by it. This is a landmark achievement, demonstrating strong order book and robust demand for infrastructure execution in India as well as international markets, and puts us firmly on the path of continued growth.

Interpreting the KEC International Order Book

The order book is the sum of confirmed contracts plus bids won by a company, but not yet performed. To an Engineering, Procurement, and Construction (EPC) company like KEC International, this ratio is of utmost importnance — it is indicative of future revenue visibility, project pipeline strength and the health of the company in securing work across sectors and geographies.

More than simply a numeric level, KEC’s order book of more than ₹42,500 crore is also reflective of the breadth and depth of products and services that qualify the firm across Power Transmission & Distribution (T&D), civil construction, transportation infrastructure, renewables, cables etc. Strong order backlog provides several quarters of revenue visibility and is reflective of client confidence world-wide.

Analysis of the Most Recent Order Book Statistics

According to company disclosures:

- Confirmed Order Book: ₹34,088 crore

- L1 Positions: Approx. ₹8,500 crore

- Total Order Book + L1: More than ₹42,500 crore

The addition of L1s (on which KEC has emerged as the lowest bidder) and potential conversion of these into confirmed orders will provide investors/industry observers better visibility on near-term prospects. This combined backlog further provides a robust visibility of contracts for KEC over the next few quarters.

Demand: Domestic and International A Balanced Portfolio

“Perhaps one of the most compelling things about KEC’s order book narrative is the regional diversity in those orders and their source. During the reported period, the order inflow was evenly balanced between domestic and international markets, highlighting KEC’s geographical spread. Such diversification supports the company in reducing regional economic risks and its ability to access fast growing markets across the globe.

In recent years, KEC International has strengthened its presence in key international markets such as the Middle East, SAARC Countries, Americas and East Asia Pacific — winning major orders for high-voltage infrastructure projects like transmission lines, substations among others. These overseas victories have also been instrumental in bolstering the momentum of the overall order book.

Driving the Order Book Sector-Wise Performance

Power T&D business vertical continues to be the one around which KEC story of growth revolves; It contributed a 69% share in terms of total order inflows ~INR72bn cumulative intake during Q2/FY19. The company specializes in designing, supplying and installing high voltage transmission lines making it an EPC partner-of-choice for utilities, independent power producers, and governmental agencies such as the Indian Railways.

Beyond T&D, KEC’s portfolio includes:

- Construction of civil infrastructure: Industrial projects and Urban works

- The Transport Infrastructure: Railways, bridges and metro infrastructure

- Energy: Solar EPC and green energy installations

- Cable: Power, telecommunication, and special cable supply

That’s a well-diversified blend that both aids the company in growing its order book and provides insulation from any one sector.

Management Commentary and Strategic Outlook

Approach The Company Officials “We have been able to maintain the momentum of our order inflow with a keen focus on high growth potential segments.Led by an all-time high order book, we look forward to FY21 as another year of progress for KEC,” said Vimal Kejriwal, MD & CEO, KEC International Ltd. Even in the face of issues such as labor shortages and geopolitical uncertainty, KEC has continued to post particularly strong revenue growth and profit with a sharp drop in debt. The strong tender pipeline also enhances the company’s visibility of new wins and growth ahead.

KEC”s orderbook successes are combined with consistent operational upliftment in major performance indices. This can lead to better cash flows, enhanced profit margins and improved execution efficiency — all of which will shore up investor confidence and market positioning.

Why This Matters for Investors and the Industry

For investors, a strong KEC International order book signifies:

- Revenue visibility: A heavy backlog means future revenues are mostly guaranteed via contracts already awarded.

- Challenges Market confidence: Strong order inflows indicate client confidence in KEC’s execution abilities.

- Runway for growth: “The large tender pipeline implies a plethora of potential opportunities down the line.

Order book power appears most likely to EPC company future performance one of the most trusted yardsticks in the market. KEC’s ability to win big projects in various sectors across different geographies would put the company in a good position amid India’s focus on infrastructure development and global energy transition.

Challenges and Considerations

While the large order book is a positive, we believe one needs to be mindful of on-the-ground execution risks in big EPC companies that remain at elevated levels. Project timelines and margins can be impacted by disruptions in supply chains, labour availability, project postponement and macroeconomic uncertainties.

Nevertheless, while KEC’s order book is diversified and it spread geographically across the globe, which gives the company a structural edge in dealing with such risks. The firm’s History of execution and balanced sector exposure are key mitigants to volatility.

Future Prospects and Growth Pipeline

Going forward, KEC International is exploring expansion strategies through emerging markets and new business verticals, such as renewables, urban infrastructure and marquee telecommunication projects. The company’s robust orderbook and an active tender pipeline worth hundreds of thousands of crores provide a strong underpinning for long term growth.

With India’s infrastructure modernization and the global energy network in demand, KEC International is well placed to create enduring shareholder value and continue its operational momentum.

Conclusion

Expansion of the KEC International order book to an all-time high level to more than ₹42,500 crore is a testament of its strong competitive strength and integrated business model and global market relevance. This feat reiterates KEC’s leadership position in EPC space, and marks the beginning of another growth journey, both domestically and internationally. The robust order book acts as a strong value proposition for investors and industry players alike in the form of high revenue visibility, strategic resilience, and long-term growth.

Must Read-: Microsoft CEO Satya Nadella: Background, Leadership, and Role in the AI Era